Student Loans: The Road Ahead

The payment pause on student loans that has been in place for 3 years ends on September 1, 2023. On that date, interest starts to grow, and payments will be due in October 2023. Many borrowers are not ready to restart payments, can’t afford their payments, or don’t know how to get out of default. The following programs may help you, depending on your situation.

Not Ready? You May Be Able to Ease into Payments Via the On-Ramp

The Department of Education has created an “on-ramp” program to get borrowers back on track. This program started on June 30, after the Supreme Court blocked the Biden Administration’s student-debt forgiveness program. As part of this on-ramp program, borrowers who miss payments will not be seen as delinquent, will not have missed payments reported to credit bureaus, won’t have their debt sent to collection agencies, and will not have their debt placed in default. However, interest on loans will continue to grow, so balances on the debts will continue to grow.

New Low (Or No) Payment Plans Through SAVE

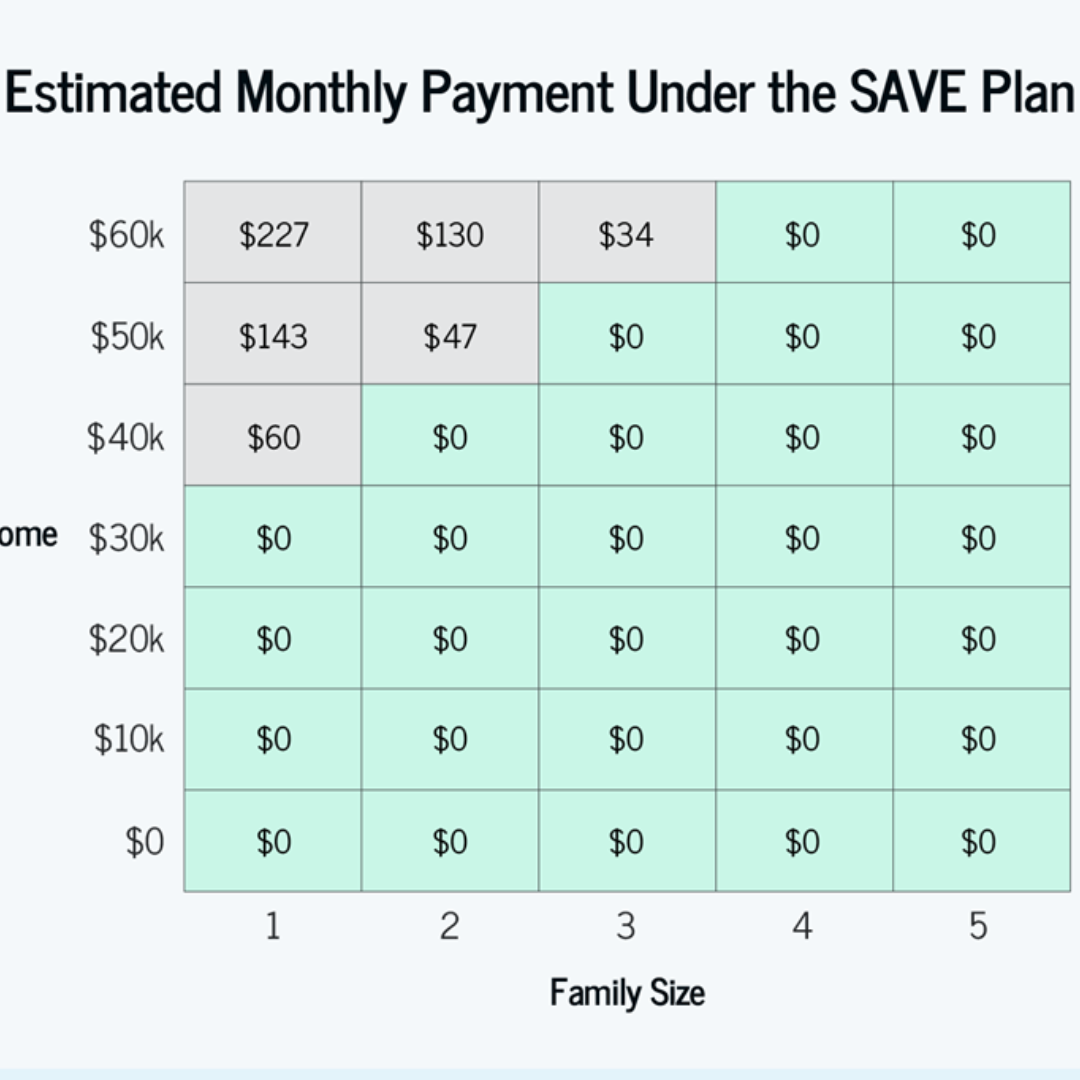

The Department of Education is rolling out a new repayment plan, called SAVE. The Saving on a Valuable Education (SAVE) Plan offers lower monthly payments and replaces the REPAYE Plan you have. If you are already signed up under REPAYE you will be switched to SAVE. If you aren’t enrolled, you can apply here https://studentaid.gov/idr/

The SAVE plan bases your repayment on income and family size. SAVE rises the income exemption from 150% to 225% of the poverty line. This means that many lower to middle income borrowers may have a payment of $0 per month. If borrowers make their monthly payment, the loan balance won’t grow due to unpaid interest. Rather than use the On-Ramp to put off repayment, borrowers should see if they are eligible for lower or no payments under SAVE. https://studentaid.gov/announcements-events/save-plan

How Does That Help Me? My Loans Are in Default

In addition to getting borrowers who stopped payment during the pause back on track, the Department of Education has created a program called Fresh Start to help borrowers remove their loans from default. This means your loans will go back into repayment status and that collection action will not begin after the pause. This can be life-changing to someone whose credit has been ruined by defaulted student loans. This program only lasts until August 31, 2024, so get started in one of the following ways:

Online: myeddebt.ed.gov

Phone: Call 1-800-621-3115 (TTY 1-877-825-9923)

Mail: Send a letter with your name, Social Security number, date of birth, and “I would like to use Fresh Start to bring my loans back into good standing” to:

P.O. Box 5609

Greenville, TX 754063

Undue Hardship and Bankruptcy

As you may have heard, it is very, very hard to get your student loans discharged in bankruptcy. Due to new policy changes, you may be eligible for removal of your loans in Arkansas if the court finds that the debt creates an “undue hardship.” Some factors include being unemployed for 5 to 10 years, good faith efforts to repay what you can when you can, being over 65, being disabled or having an illness impacting income potential, failure to finish the degree for which the loan was made, and not able to maintain a minimal standard of living if forced to repay the loans. For more information on how this may affect you and your situation, contact an attorney, or call our Help Line to see if you qualify for free services.

AUTHOR: HELEN NEWBERRY, STAFF ATTORNEY FOR CENTER FOR ARKANSAS LEGAL SERVICES